If you have frequent business expenses then QuickBooks is a good choice for you. It costs an additional $250 to add other people to your account.Monthly subscriptions required from $15 to $35 a month.Ideal for all your business bookkeeping.Can keep track of all business expenses and keep them separate from personal expenses.You can plan specifically for small businesses, self-employed, and accountants.It's a seamless place to do all your business bookkeeping. Quickbooks is the perfect budgeting apps for small businesses and individuals who are self-employed. It has no fees, no minimum balance requirements, and an Annual Personal Yield (APY) of 1.55%. You can use Personal Capital's saving account to keep any extra cash. They even off their own high yield savings account called Personal Capital Cash.

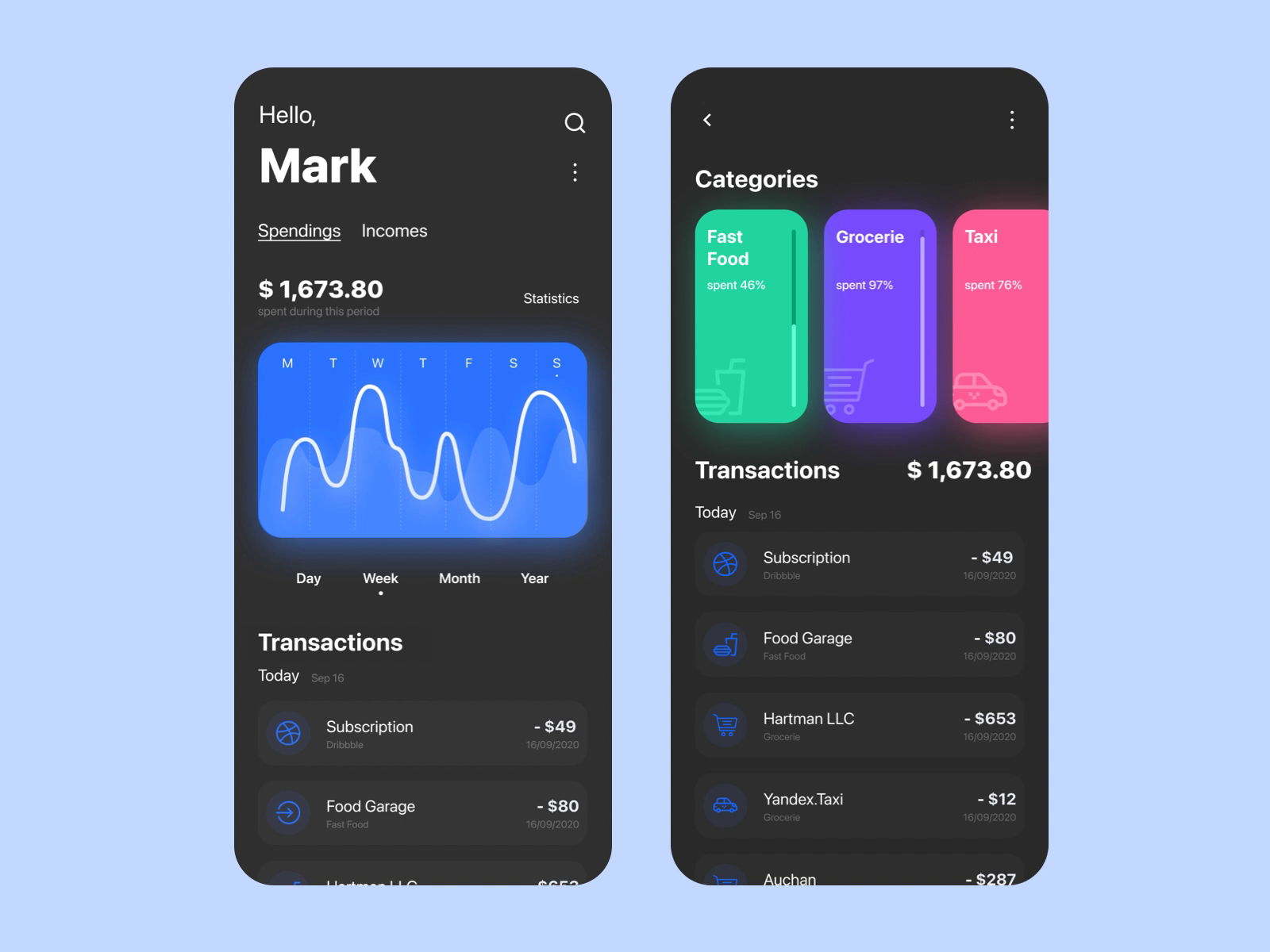

You can sync the app to your personal bank accounts, your retirement funds, investments, IRA, and even debts, all in one seamless dashboard. With the Personal Capital app, you can do just about anything. Less ideal if you don’t have a lot of money flow going to different places.Doesn’t allow you to share or link with other users.Not the most ideal option for personal, basic budgeting.Designed primarily to track your net worth, cash flow, and investment portfolio.Compatible with desktop and mobile devices.Free analytics tool to track cash flow over a period of time.Available financial advisors to offer recommendations backed by data.Allows you to connect accounts: savings, checkings, investments, retirement, credit card accounts, mortgage.

#Best personal expense tracker app full#

This app makes a great place to keep your full financial portfolio.

The Personal Capital Budget App is great for individuals who want to grow their personal wealth and want to better keep track of all their investments.

0 kommentar(er)

0 kommentar(er)